- Gen3 Melons

- Posts

- ARB Is Live & Ready to Mingle

ARB Is Live & Ready to Mingle

Hello, fellow melon! 🍉

Welcome back to another exciting day in web 3.

Here's what you’ll get today:

📈 Market news

👄 Trending tweets

👀 Major adoption events and announcements of the week

🥇 Coin of the week

🔧 Tool to boost your productivity

🧠 Crypto quote of the week

ARB Is Live & Ready to Mingle 😉

Bitcoin Breakes Correlation with Nasdaq and S&P 500 📈

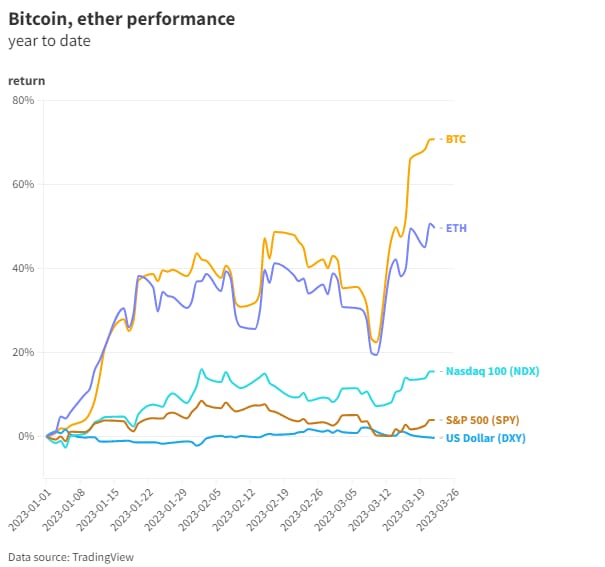

The US Federal Reserve has recently shifted its policy towards quantitative easing, which has resulted in a boost for cryptocurrencies such as bitcoin and ether. Year-to-date, both assets have seen significant increases of 69% and 49.5% respectively, with prices reaching around $28,000 and $1,800.

In just the past couple of weeks, they have surged even further, with gains of 35% and 26%, due in part to the recent failure of Silicon Valley Bank. This strong performance in the crypto market far exceeds that of tech and growth stocks listed on the Nasdaq exchange, which have seen increases of only one-fifth of the cryptocurrencies' gains over the same period.

Meanwhile, the balance sheet of the Federal Reserve has just expanded by approximately $300 billion since the onset of the banking crisis, effectively reversing around 50% of the $600 billion in quantitative tightening measures they had previously enacted since March of 2022. This can only mean one thing, the money printing machine is back on.

According to Glassnode in its weekly video report, on Tuesday, the actions are translating to further upside for digital assets.

The Federal Reserve will have a tough decision to make in the coming months.

Today's Fed announcement in a nutshell

— Morning Brew Daily (@mbdailyshow)

4:02 PM • Mar 22, 2023

Hostile Regulation Incoming ⚠️

The fear of hostile regulation from the major economy in the world has increased in the past few days due to a new report issued by the White House about the digital asset industry. The truth is it's not looking too good for our beloved crypto.

In its 36-page chapter, the report went on and on about how crypto assets are nothing more than "speculative investment vehicles." And apparently, digital assets are just too volatile because they lack fundamental value.

But wait, it gets better! The report also claims that the crypto industry's main objective is to create artificial scarcity to prop up prices.

The report's criticisms have raised some valid concerns about the need for regulation to protect consumers, investors, and the financial system from potential risks related to crypto assets. More clarity about the possible regulation is yet to come.

Word in the Hood 👄

JUST IN: 🇺🇸 White House says #crypto assets do not offer "any fundamental value, nor do they act as an effective alternative to fiat money."

— Watcher.Guru (@WatcherGuru)

11:12 PM • Mar 21, 2023

Thanks to the politicians and banks for once again proving the profound need for cryptocurrencies. A whole new generation will understand and appreciate the philosophy and innovation of our industry

— Charles Hoskinson (@IOHK_Charles)

4:08 PM • Mar 19, 2023

Ark Invest's Cathie Wood: We believe the behavior of #Bitcoin through this crisis will attract more institutions.

"There is no central point of failure in #Bitcoin" 👏

— Bitcoin Magazine (@BitcoinMagazine)

12:24 PM • Mar 23, 2023

Adoption Events of the Week 👀

PwC Germany has entered into a strategic collaboration with

@ChainlinkLabs to accelerate enterprise #blockchain adoption.

Deloitte, one of the Big Four accounting firms is betting on immersive experiences and other Web3 solutions to address various corporate needs.

Hong Kong to allow #Bitcoin ETFs for retail investors.

Sony filed a patent to bring interoperability to NFTs in video games.

Crypto Announcements of the Week 👀

VeChain announced a partnership with Canadian IT firm, Micromation Inc, to enhance product traceability in the global supply chain industry. VeChain aims to revolutionize $30 billion supply chain management sector.

OP3N, the #Web3 #AI-powered platform, has raised $28 million in Series A funding, led by Animoca Brands, with participation from Dragonfly Capital, Warner Music Interactive, and more. With its chat-based product, Superapp, integrating #blockchain and decentralized technologies, OP3N aims to become the decentralized Facebook, YouTube, Spotify, or WhatsApp for Web3.

COIN OF THE WEEK 🥇

Arbitrium (ARB) 🔥

Arbitrum is the biggest Ethereum layer 2 player out there and after deploying the long-awaited token airdrop is now available in multiple exchanges for trading, or ready to mingle.

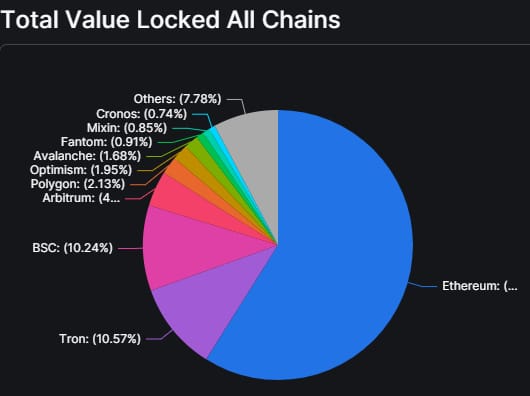

In fact, Arbitrum is currently ranked fourth in terms of TVL, even surpassing Polygon and many other popular L1 blockchain networks like Avalanche, Fantom, and Solana in terms of TVL.

Arbitrium is currently ranked fourth in terms of TVL

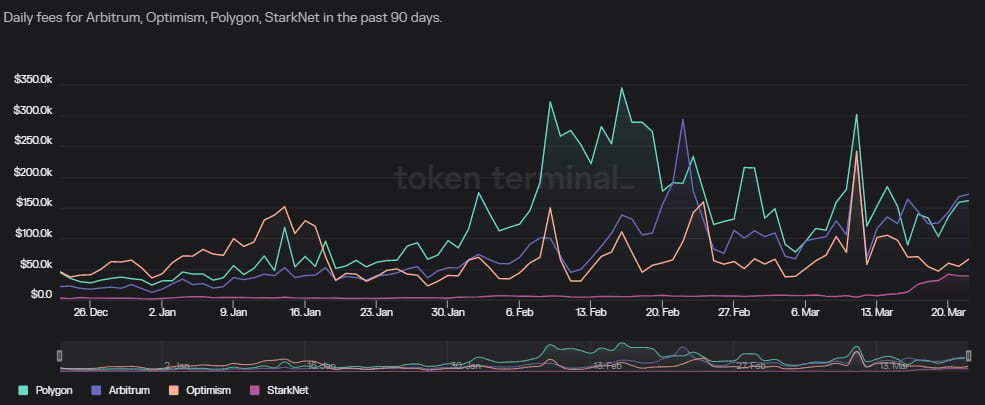

On March 17th, Arbitrum hit an all-time high of 172.4k active addresses, indicating a sharp rise in the number of daily users on the platform. This trend suggests that more users are migrating to these Ethereum L2 solutions, seeking faster and cheaper transaction processing and other benefits.

In late February, the number of transactions on Arbitrum surpassed those on Ethereum. Arbitrum transactions have surpassed those on Ethereum once again, with another flip occurring on March 16th. Transactions on Arbitrum have remained steady at around 1 million since then.

Tokenomics

Arbitrum has announced that it will be distributing 12.75% of the total ARB supply. This distribution has led to speculation about the potential value of the ARB token.

A reasonable and quantitatively based valuation framework suggests that the token will likely trade in the $1 to $2 range. After early volatile trading, the price of ARB has settled around this range according to Coingecko.

Overall, the ARB distribution to early users and DAOs is expected to increase the token's utility and value. You can access their whitepaper here.

Why It Has Potential

The total value locked and the increasing amount of transactions on the Arbitrium network validate the potential of this token. In terms of utility, with Arbitrium Orbit anyone can easily launch a new Arbitrum chain as a Layer 3 in the Arbitrum ecosystem. It is expected the ARB token to increase in value in the next bull market, leading the L2 race for blockchain adoption and scalability.

TOOL OF THE WEEK 🔧

Canva

Following the AI trend, Canva announced an AI drop earlier this week for its 125 million users, which will be getting:

Text-to-slide deck

AI-generated presentation

Erase and replace items in an image

Image-to-design template (e.g., auto-creating a fully-designed flyer using an image)

More AI-generated text, now supporting 18 languages

Better and faster text-to-image

This announcement puts Canva side-by-side with Adobe and a new generation of presentation and design tools driven by AI.

QUOTE OF THE WEEK 🧠

"Blockchain technology isn't just a more efficient way to settle securities. It will fundamentally change market structures, and maybe even the architecture of the Internet itself."

PASS ON THE MELON 🍉 & HELP US SPREAD THE WORD 👇

EXTRA PICKS

Tutorials 🎓

What How To Create An ENTIRE NFT Collection (10,000+) & MINT In Under 1 Hour Without Coding Knowledge. Link

What To Read 📖

What is the fundamental value of cryptocurrencies? By Toulouse School of Economics. Link

What To Watch 📺

To your financial health! 🙏

Gen 3 Melons

For Web 3 Brands 🚀

If you are a web 3 brand looking to grow your project, check out Gen3 Melons. Let’s chat and see how we can help!

DISCLAIMER: This newsletter is for informational purposes only. None of the content from this newsletter is financial advice. It is intended to provide educational and informative content only. It is important to do your own research and make your own decisions before investing in any asset. While we strive to provide accurate and up-to-date information, we cannot guarantee the accuracy or completeness of the information provided in this article. Remember, investing is a personal decision, and what works for one person may not work for another.